New Company Return Form (Form C) for Year of Assessment 2019 Released by the Inland Revenue Board of Malaysia (IRBM)

We wish to highlight that the Inland Revenue Board of Malaysia (IRBM) has recently released a new format of the Company Return Form (Form C) for Year of Assessment 2019.

(A) CONTROLLED TRANSACTIONS

In IRBM’s continued efforts in tightening transfer pricing compliance, they have included additional disclosure requirements in respect of controlled transactions, and these include the following:-

1. Companies with controlled transactions under Section 139 and 140A of the Income Tax Act, 1967 (the Act)

2. Details of exempted foreign income received from foreign countries as per Schedule 6 Para 28 of the Act

3. Information for purposes of interest expense limitations (under Section 140C of the Act)

If your company has controlled transactions, a new Schedule (HK-N) is required to be completed. The taxpayer is to indicate if the Company is involved in any controlled transaction*. In the event the Company has controlled transactions, the Company is further required to provide a list of controlled transactions as below (in brief):-

• If Transfer Pricing documentation is prepared for the year;

• List of subsidiaries and associate’s persons;

• Name of company and country if taxpayer has any transaction with countries having lower tax rates compared to Malaysia (if applicable);

• Characterisation / business activities of the Company;

• Information in relation to business restructuring (if applicable);

• Information pertaining to Research and Development (“R&D”) activities performed by the taxpayer (if applicable);

• If taxpayer involved in any cash pooling activities (if applicable);

• Particulars of transactions with related companies and associated persons (both related parties inside and outside Malaysia);

*As defined under Section 140A of the Income Tax Act 1967

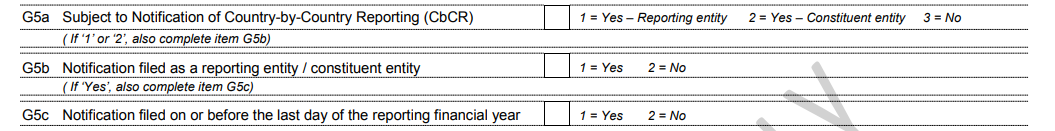

(B) Country-by-Country Reporting (CbCR)

The IRBM has also introduced new disclosure items in the Form C with regard to CbCR as below

What needs to be done?

With the additional information required, the IRBM is expected to conduct more informed and targeted audits. Baker Tilly will be able to assist by putting the necessary and relevant documentation in place to comply with the new requirements. Failure to adhere to such requirements could result in an incomplete or inaccurate return, which may lead to the company being penalised.

For any enquiries or assistance, please contact any of the following in this office:

Mr Anand Chelliah

Managing Partner, Tax Services

Asia Pacific Tax Leader

DL: +6 (0)3 2297 1093

anand.chelliah@bakertilly.my

Mr Yohan Francis

Executive Director, Tax Services/ Transfer Pricing

DL: +6 (0)3 2297 1096

yohan.xavier@bakertilly.my

Thank you.